Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

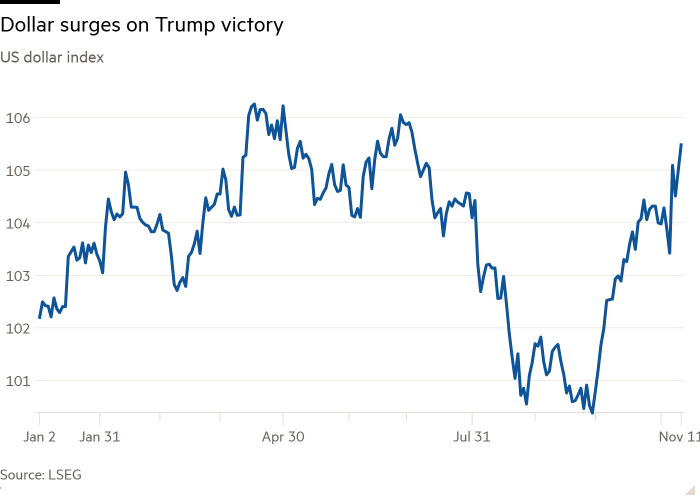

Bitcoin hit a fresh record, the US dollar rose to a four-month high and Tesla shares jumped, as investors raised bets on the big winners from Donald Trump’s US presidential election victory.

The dollar was up 0.5 per cent against a basket of its peers on Monday, passing the level it hit the day after the election last week and taking it to its highest since July. The euro fell 0.6 per cent to $1.066, its lowest level since May.

Bitcoin, which has hit a series of record highs in the wake of the election, surged 8 per cent to $82,311, as Republicans looked increasingly likely to take control of the House of Representatives, having already won a majority in the Senate.

The Trump administration is widely expected to be supportive of the crypto industry and, with control of both chambers of Congress, would have greater power to enact favourable legislation.

Among equities, Tesla, the electric vehicle maker run by Trump backer Elon Musk, was up 7 per cent in pre-market trading. The company has surged past $1tn in market cap since election day, helping boost Musk’s personal net wealth by about $32bn. Cryptocurrency exchange Coinbase rose 16 per cent.

“What we are seeing is that people are keen to jump on the Trump-trade sooner rather than later,” said Emmanuel Cau, head of European equity strategy at Barclays.

The performance of crypto and other so-called “Trump trades” showed growing anticipation that the former president would take a light-touch approach to regulation during his second term, said Mabrouk Chetouane, head of global market strategy at Natixis Investment Managers.

“Investors are willing to take risks, even with more protectionism in the pipeline,” he said, referring to Trump’s plans to sharply increase tariffs on imports to the US.

The Republican candidate’s decisive victory drove traders to price in the president-elect’s promises of tax cuts and tariffs, fuelling the dollar and sparking a sell-off in US government bonds.

Trading in Treasuries, which have recovered much of their post-election losses, is closed for the Veterans Day public holiday in the US. Futures on the S&P 500 and Nasdaq 100 indices were up 0.4 per cent.

The Financial Times reported last week that Robert Lighthizer, Trump’s trade envoy during his first term trade war with China, had been asked to take the job again. “Any clues on Trump’s appointments may be market moving,” said Deutsche Bank’s Jim Reid.

The Mexican peso, which had performed poorly in the run-up to the election and was highly volatile on election day, was down 1.4 per cent to 20.45 to the dollar.