Last week, ExxonMobil promised to achieve carbon neutrality in its operations by 2050. How? It would be like Philip Morris International promising that none of its workers will smoke while manufacturing cigarettes.

Speaking of which, Big Oil’s latest greenwashing forays make perfect sense through the lens of Big Tobacco’s playbook.

Big Oil following Big Tobacco’s playbook will be devastating for the environment.

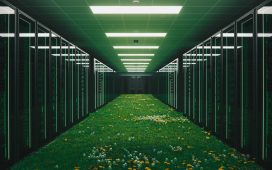

Shutterstock

With oil hovering at $85 per barrel, neither Exxon nor its peers have any desire whatsoever to sell less oil. Sure, a growing population of electric vehicle (EV) drivers in rich countries are done visiting the gasoline pump. Big Oil seems to be fine with that—if, indeed, they can replicate Big Tobacco’s infamous pivot.

The Big Tobacco Playbook

In 1964, U.S. Surgeon General Luther Terry issued a 150,000-word report conclusively linking cigarette smoking to lung cancer. Despite Big Tobacco’s efforts to obfuscate the science and fight anti-smoking policies, American cigarette consumption declined over the next 50 years, preventing an estimated 8 million premature deaths. Much of the developed world followed suit.

Nevertheless, Big Tobacco stocks surged upwards in the 2000s. The companies reoriented towards unregulated markets in the developing world. Of the 1.3 billion people who smoke today, over 80% live in low- and middle-income countries. In 2016, China alone accounted for over 41% of worldwide cigarette consumption. Meanwhile, Philip Morris says it has a “…mission to one day stop selling cigarettes.”

Today, Big Oil is running that same play. Much like Big Tobacco, Big Oil has lost the scientific and public opinion battle in the West, and not for a lack of investment in disinformation and lobbying. It acknowledges the threat of climate change but advocates for an “orderly energy transition” in which demand for oil falls gradually in wealthy countries, and the rest of the world takes decades to catch up. That orderly transition will not achieve global carbon neutrality by 2050. Not by a long shot.

Here is the thing: the International Energy Agency (IEA) predicts that through 2030, fossil fuel demand will grow everywhere in the world except for North America, Europe and Japan. Chinese demand for cigarettes saved Big Tobacco when the developed world kicked the habit. Well, over 87% of China’s energy consumption comes from fossil fuels, and the country accounted for 24% of global energy consumption in 2020. It could help save Big Oil, too, but in the process push climate change over the brink.

India, likewise, will double energy consumption between 2021 and 2040, accounting for 25% of demand growth worldwide. 80% of its demand is still met by coal (44%), oil (25%) and solid biomass (13%). Big Oil sees decades of big business ahead—if it secures that orderly energy transition.

Big Promises, Little Accountability

Big Oil’s tobacco-inspired strategy has three components. First, double-down on sales abroad. Second, greenwash at home. Third, spend lavishly on share buybacks instead of investments in clean energy. While shareholders cheer this strategy, it thoroughly undermines plans to achieve carbon neutrality by 2050.

Oil executives will insist that I’m being too harsh! Don’t I know about their investments in renewables, charging stations, hydrogen and “carbon management”?

Let’s chat about those, shall we?

First, notice how long-time partners—automakers and Big Oil—are parting ways. General Motors has boosted its investment in EVs and autonomous vehicles (AVs) to $35 billion between 2021 and 2025—a 75% increase. Volkswagen Group will invest €52 billion in “e-mobility” over the next five years—50% more than originally planned. Toyota, similarly, has committed $35 billion to introduce a lineup of 30 EVs by 2030.

Not bad. Now how about Big Oil?

Consider Royal Dutch Shell. It accounted for 2.3% of global greenhouse gas emissions between 1965 and 2017 according to the Climate Accountability Institute. The IEA estimates that annual clean energy investment must triple to $4 trillion by 2030 if we are to achieve net-zero emissions by 2050. So, Shell’s promise to increase its clean energy spending to $3 billion annually means that the company is offering to invest 0.075% of what is required to reach net-zero—one-thirtieth of its historical contribution to our climate disaster.

Shell is hardly unique. Exxon intends to spend $15 billion over the next five years on hydrogen, carbon capture and storage (CCS) and biofuels, which are notable for their lack of a high-margin business model. Exxon is accountable for 3.01% of emissions since 1965, meaning that Exxon’s investment amounts to 0.375% of what is required to achieve net-zero emissions globally.

Big Oil will invest just enough in clean energy companies to deflect criticism—and ensure that none turn into real competitors. Meanwhile, Big Oil reserves its budgets for a much bigger expense: share buybacks. Shell has pledged $5.5 billion in buybacks using funds from asset sales in the Permian Basin. Exxon, not to be outdone, is targeting $10 billion in buybacks next year out of capital expenditures of $20 to $25 billion. This multibillion-dollar thank you to their investors sends a message: stick with us, and we’ll take care of you.

Moral Flexibility

In the film Thank You for Smoking, tobacco lobbyist Nick Naylor tries to explain his job to his son Joey. “It requires a moral flexibility that goes beyond most people,” says Naylor. Likewise, some executives at oil majors have become moral yogis, gymnasts and contortionists.

We all understand that we cannot just turn a magical switch and suddenly be carbon neutral. The world does need an “orderly energy transition”—just not the kind where Big Oil prioritizes its stock market performance over humanity’s future.

The elephant in the room is the developing world. Many countries believe they cannot maintain economic growth or lift their populations out of poverty without cheap hydrocarbons. That’s how the West did it, after all. Thus, China and India will not limit fossil fuel usage unless alternative energy sources are able to deliver abundant, affordable, safe, clean energy.

Our best hope is to prove that clean energy can outcompete Big Oil and the Big Tobacco playbook. I, for one, believe clean energy innovators can do it—if governments support them with fossil fuel consumption limits, carbon markets and an end to fossil subsidies. Meanwhile, investors must put their money where their ESG mouths are. Time is of the essence. Please look up – and act!