Stocks may be hovering around all-time highs, but there’s one area of the market that isn’t feeling the heat: energy.

The sector has gained 8% this month, but it’s still on pace to end the quarter in the red, and it’s still hovering around bear market territory. By comparison, the 10 other S&P sectors are higher for the quarter, and not one is even in correction territory — let alone approaching a bear market.

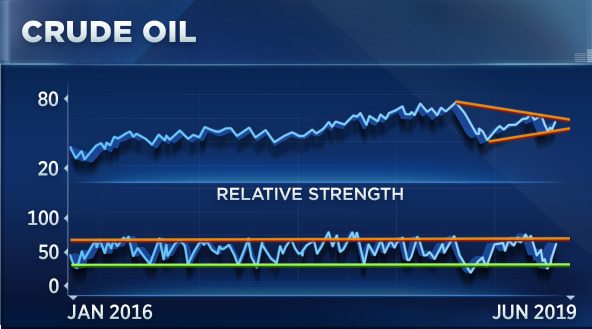

But Miller Tabak’s Matt Maley says that on the back of crude oil’s rally the sector may finally be starting to show signs of life. He also says investors should specifically be watching Schlumberger. After years of underperforming, the stock chart suggests the energy giant might be poised to rally.

The last five years have been bleak ones for the Houston-based oil services company — shares have slid nearly 70% while the broader market has climbed roughly 50%. Maley says one notable exception during that time period was 2016, when the stock “acted quite well.” He says the current stock chart resembles three years ago, suggesting it might soon turn a corner, which is further supported by the stock’s “double bottom.” This is a pattern technicians use to evaluate a stock’s trend, and in this case it suggests a reversal to the upside.

“The stock, at its most recent sell-off back in May, held its December lows, forming a double bottom. That’s very bullish,” Maley said Wednesday on CNBC’s “Trading Nation.” He’s watching the key low $40 price, because if the stock can break above that level it will confirm the “double bottom” formation.

“Forty-one dollars, $42, that’s where the trend line comes in from mid-2018. If it can break above that level that’s going to give the stock a lot more upside potential,” he said.

Given Schlumberger’s size — with a market cap of $54 billion, it’s the fourth-most heavily weighted component in the S&P Energy Sector — a move higher could lift the sector as a whole.

“It’s not just the next couple of days. But the next few weeks, even the next two months. Keep an eye on Schlumberger. If that finally starts to move, because it’s very highly weighted in both the XLE and OIH oil services ETF, it could be really good for the entire sector, which I think is somewhat under-owned,” Maley said.

But some investors, like Joule Financial’s Quint Tatro, aren’t as sold on energy. While he noted that “there’s no question” Schlumberger will benefit if oil continues its push higher and that the company has a “healthy balance sheet” and is “fundamentally attractive,” he cautioned that investors should understand what they’re buying.

“Here’s the problem with Schlumberger: They’re set to earn $2 next year. Their dividend is $2. So they’re not bringing anything back to the bottom line to grow their book value, or their tangible asset value. So that’s very difficult for that stock to compound any further,” he said.

Essentially, Tatro believes investors can buy the name for the “attractive” dividend, but they shouldn’t expect big “capital appreciation.”